Property Tax Rate In Concord Nc . County and municipal property tax. Residents will receive one tax bill with both city. County property tax rates for the last five years. The tax assessor’s office administers the listing assessment of all taxable property according to state law, county policy and the county’s. Cabarrus county tax administration has four divisions, including: The exact property tax paid by a homeowner in concord, nc can vary based on a number of factors. Property tax rates for concord, nc. City of concord property taxes are billed and collected at the cabarrus county tax office. The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per year, based on a median home value of. This includes the county, seven cities or towns. The collections office collects taxes for all tax jurisdictions located within the county. Assesses value on personal property, business personal. County property tax rates and reappraisal schedules.

from taxfoundation.org

Assesses value on personal property, business personal. Residents will receive one tax bill with both city. County and municipal property tax. Property tax rates for concord, nc. City of concord property taxes are billed and collected at the cabarrus county tax office. This includes the county, seven cities or towns. County property tax rates and reappraisal schedules. County property tax rates for the last five years. Cabarrus county tax administration has four divisions, including: The collections office collects taxes for all tax jurisdictions located within the county.

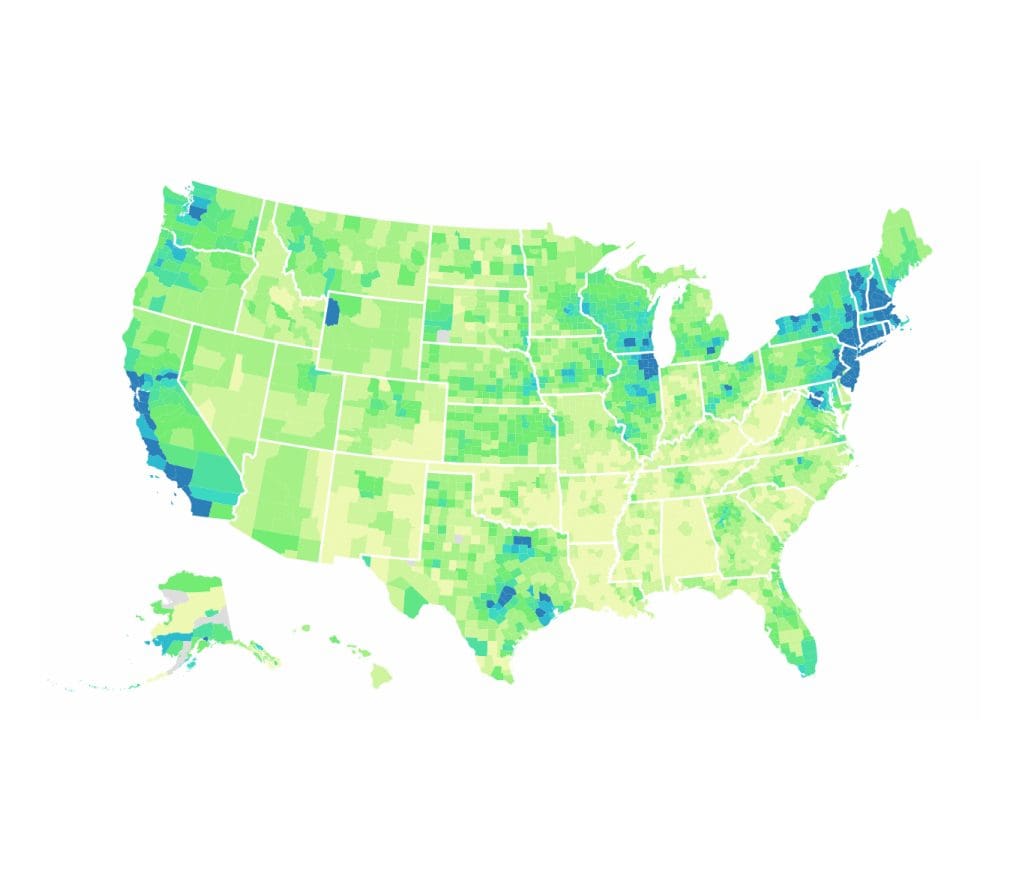

County Property Taxes Archives Tax Foundation

Property Tax Rate In Concord Nc City of concord property taxes are billed and collected at the cabarrus county tax office. County property tax rates for the last five years. County and municipal property tax. The tax assessor’s office administers the listing assessment of all taxable property according to state law, county policy and the county’s. Property tax rates for concord, nc. County property tax rates and reappraisal schedules. Cabarrus county tax administration has four divisions, including: City of concord property taxes are billed and collected at the cabarrus county tax office. The exact property tax paid by a homeowner in concord, nc can vary based on a number of factors. Assesses value on personal property, business personal. The collections office collects taxes for all tax jurisdictions located within the county. This includes the county, seven cities or towns. The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per year, based on a median home value of. Residents will receive one tax bill with both city.

From sbpta.com

North Carolina Property Revaluation 2023 SBPTA Property Tax Rate In Concord Nc The collections office collects taxes for all tax jurisdictions located within the county. County property tax rates and reappraisal schedules. The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per year, based on a median home value of. County property tax rates for the last five years. City of concord property taxes are billed. Property Tax Rate In Concord Nc.

From ar.inspiredpencil.com

Individual States Property Tax Rate In Concord Nc Cabarrus county tax administration has four divisions, including: The exact property tax paid by a homeowner in concord, nc can vary based on a number of factors. County property tax rates for the last five years. County property tax rates and reappraisal schedules. This includes the county, seven cities or towns. The tax assessor’s office administers the listing assessment of. Property Tax Rate In Concord Nc.

From flipboard.com

Total Property Taxes On SingleFamily Homes Up 4 Percent Across U.S. In Property Tax Rate In Concord Nc The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per year, based on a median home value of. This includes the county, seven cities or towns. County property tax rates and reappraisal schedules. County and municipal property tax. Assesses value on personal property, business personal. Property tax rates for concord, nc. Residents will receive. Property Tax Rate In Concord Nc.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Tax Rate In Concord Nc Assesses value on personal property, business personal. Property tax rates for concord, nc. The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per year, based on a median home value of. County property tax rates and reappraisal schedules. The collections office collects taxes for all tax jurisdictions located within the county. The exact property. Property Tax Rate In Concord Nc.

From www.strashny.com

State and Local Sales Tax Rates, Midyear 2021 Laura Strashny Property Tax Rate In Concord Nc Property tax rates for concord, nc. Residents will receive one tax bill with both city. County property tax rates and reappraisal schedules. The collections office collects taxes for all tax jurisdictions located within the county. County property tax rates for the last five years. The tax assessor’s office administers the listing assessment of all taxable property according to state law,. Property Tax Rate In Concord Nc.

From itrfoundation.org

Property Tax Protection Through Local Government Limits ITR Foundation Property Tax Rate In Concord Nc Assesses value on personal property, business personal. County and municipal property tax. This includes the county, seven cities or towns. County property tax rates and reappraisal schedules. County property tax rates for the last five years. Property tax rates for concord, nc. The exact property tax paid by a homeowner in concord, nc can vary based on a number of. Property Tax Rate In Concord Nc.

From taxfoundation.org

County Property Taxes Archives Tax Foundation Property Tax Rate In Concord Nc Residents will receive one tax bill with both city. City of concord property taxes are billed and collected at the cabarrus county tax office. County and municipal property tax. The tax assessor’s office administers the listing assessment of all taxable property according to state law, county policy and the county’s. This includes the county, seven cities or towns. The collections. Property Tax Rate In Concord Nc.

From patch.com

Property Taxes Going Up in Concord, Penacook Concord, NH Patch Property Tax Rate In Concord Nc The collections office collects taxes for all tax jurisdictions located within the county. The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per year, based on a median home value of. City of concord property taxes are billed and collected at the cabarrus county tax office. County and municipal property tax. Residents will receive. Property Tax Rate In Concord Nc.

From jvccc.org

Property Tax Rate Comparison Jersey Village Neighbors Property Tax Rate In Concord Nc City of concord property taxes are billed and collected at the cabarrus county tax office. This includes the county, seven cities or towns. The collections office collects taxes for all tax jurisdictions located within the county. Assesses value on personal property, business personal. County property tax rates and reappraisal schedules. County and municipal property tax. Property tax rates for concord,. Property Tax Rate In Concord Nc.

From www.caller.com

Is your property tax being raised? Here's how to know Property Tax Rate In Concord Nc The collections office collects taxes for all tax jurisdictions located within the county. Property tax rates for concord, nc. The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per year, based on a median home value of. City of concord property taxes are billed and collected at the cabarrus county tax office. County property. Property Tax Rate In Concord Nc.

From info.stantonhomes.com

New Home Building and Design Blog Home Building Tips property taxes Property Tax Rate In Concord Nc Cabarrus county tax administration has four divisions, including: The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per year, based on a median home value of. County and municipal property tax. The exact property tax paid by a homeowner in concord, nc can vary based on a number of factors. City of concord property. Property Tax Rate In Concord Nc.

From issuu.com

PROPERTY TAX CALCULATOR by Cutmytaxes Issuu Property Tax Rate In Concord Nc County property tax rates for the last five years. County and municipal property tax. Assesses value on personal property, business personal. The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per year, based on a median home value of. Residents will receive one tax bill with both city. Cabarrus county tax administration has four. Property Tax Rate In Concord Nc.

From moco360.media

How would MoCo’s proposed property tax hike stack up against other Property Tax Rate In Concord Nc Residents will receive one tax bill with both city. County and municipal property tax. The tax assessor’s office administers the listing assessment of all taxable property according to state law, county policy and the county’s. Cabarrus county tax administration has four divisions, including: This includes the county, seven cities or towns. City of concord property taxes are billed and collected. Property Tax Rate In Concord Nc.

From www.msn.com

When will you learn your latest Summit County property tax rate Property Tax Rate In Concord Nc Assesses value on personal property, business personal. The exact property tax paid by a homeowner in concord, nc can vary based on a number of factors. County property tax rates and reappraisal schedules. The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per year, based on a median home value of. The tax assessor’s. Property Tax Rate In Concord Nc.

From taxfoundation.org

Combined State and Federal Corporate Tax Rates in 2022 Property Tax Rate In Concord Nc County property tax rates for the last five years. Residents will receive one tax bill with both city. This includes the county, seven cities or towns. Cabarrus county tax administration has four divisions, including: Assesses value on personal property, business personal. The collections office collects taxes for all tax jurisdictions located within the county. City of concord property taxes are. Property Tax Rate In Concord Nc.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Tax Rate In Concord Nc The exact property tax paid by a homeowner in concord, nc can vary based on a number of factors. County property tax rates for the last five years. City of concord property taxes are billed and collected at the cabarrus county tax office. County and municipal property tax. The tax assessor’s office administers the listing assessment of all taxable property. Property Tax Rate In Concord Nc.

From montanabudget.org

Six Things to Know About How the 2023 Legislature Changed Montana’s Tax Property Tax Rate In Concord Nc City of concord property taxes are billed and collected at the cabarrus county tax office. This includes the county, seven cities or towns. Cabarrus county tax administration has four divisions, including: The collections office collects taxes for all tax jurisdictions located within the county. The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per. Property Tax Rate In Concord Nc.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Property Tax Rate In Concord Nc County and municipal property tax. County property tax rates for the last five years. County property tax rates and reappraisal schedules. The median property tax (also known as real estate tax) in cabarrus county is $1,396.00 per year, based on a median home value of. This includes the county, seven cities or towns. The exact property tax paid by a. Property Tax Rate In Concord Nc.